Europe Medical Foods Market Size, Share and Analysis, 2034

Europe Medical Foods Market Size

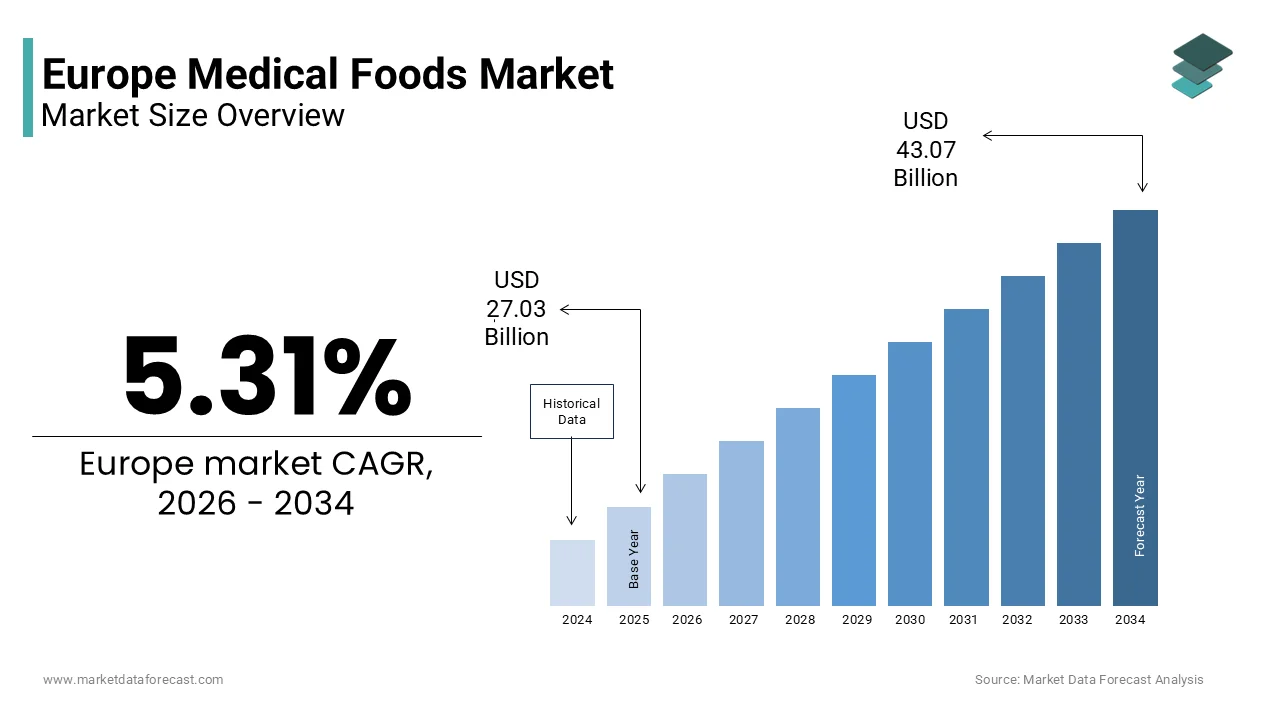

The Europe medical foods market size was valued at USD 27.03 billion in 2025 and is projected to reach USD 43.07 billion by 2034 from USD 28.47 billion in 2026, growing at a CAGR of 5.31%.

Medical foods are specially formulated and processed products intended for the dietary management of specific diseases or conditions with distinctive nutritional requirements that cannot be met by normal diet alone. These products range from oral nutritional supplements to enteral formulas and are used under medical supervision for conditions such as cancer cachexia, chronic kidney disease, inborn errors of metabolism, dysphagia, and neurodegenerative disorders like Alzheimer’s. Unlike general dietary supplements, medical foods are governed under EU food law as “foods for particular nutritional uses” and must demonstrate scientific substantiation for their intended clinical purpose. According to the European Food Safety Authority, medical foods are not medicines but are recognized as essential components of integrated patient care pathways where nutrition directly influences clinical outcomes. As per Eurostat, a significant share of the EU population was aged 65 or older in 2023, which is a demographic shift intensifying demand for therapeutic nutrition due to higher prevalence of age-related chronic diseases. Furthermore, the European Society for Clinical Nutrition and Metabolism reports that malnutrition affects many hospitalized patients across the EU, often exacerbating recovery times and increasing healthcare costs. This confluence of aging populations, rising chronic disease burden, and evidence-based recognition of nutrition as therapy positions medical foods as a critical yet often underutilized pillar of Europe’s evolving healthcare ecosystem.

MARKET DRIVERS

Aging Population and Rising Prevalence of Chronic Diseases Drive Demand

Europe’s rapidly aging demographic structure is a primary catalyst for medical food consumption as older adults face elevated risks of sarcopenia, malnutrition, and chronic conditions requiring specialized nutritional intervention, which is a key factor propelling the growth of the European medical foods market. According to Eurostat, a significant proportion of Europeans were aged 65 and above in 2023, and this cohort is projected to continue rising by 2030. Age related physiological changes increase vulnerability to protein energy malnutrition, particularly during hospitalization or chronic illness. According to the European Society for Clinical Nutrition and Metabolism, many elderly outpatients with heart failure or chronic obstructive pulmonary disease exhibit clinically significant malnutrition, which is requiring high protein oral nutritional supplements. Moreover, neurodegenerative diseases such as Alzheimer’s affect millions of people in the EU, many of whom develop dysphagia or feeding difficulties requiring texture modified or tube fed medical foods. National health systems increasingly recognize the cost effectiveness of early nutritional intervention, with data from Germany’s Federal Joint Committee showing that hospital readmissions among geriatric patients decreased when prescribed medical foods were included in discharge planning. This clinical and economic validation embeds medical foods into standard care protocols across primary and secondary healthcare settings.

Integration of Medical Nutrition into Hospital and Home Care Pathways

The formal incorporation of medical foods into clinical guidelines and care pathways across European healthcare systems has institutionalized their use beyond ad hoc supplementation, which is further boosting the medical foods market expansion in Europe. According to the European Commission’s State of Health in the EU report, many member states now include oral nutritional supplements in national malnutrition screening and treatment protocols for hospitals and long-term care facilities. In countries such as the Netherlands and Sweden, reimbursement mechanisms allow physicians to prescribe medical foods as part of integrated care plans for conditions including cancer, renal failure, and post-surgical recovery. The Dutch Healthcare Institute includes specific enteral formulas in its Diagnosis Treatment Combination system, which is enabling cost neutral adoption by providers. Similarly, France’s National Authority for Health recommends medical foods for patients with inborn errors of metabolism, ensuring coverage under the national health insurance scheme. As per the data from the Organisation for Economic Co-operation and Development, EU countries with structured medical nutrition policies reduced average hospital stays for malnourished patients compared to those without. Furthermore, the shift toward home based care has increased demand for ready to use sip feeds and modular powders that enable safe outpatient management. This systemic embedding transforms medical foods from optional aids into essential therapeutic tools within Europe’s value-based healthcare framework.

MARKET RESTRAINTS

Stringent Regulatory Ambiguity and Lack of Harmonized Classification

Despite their clinical utility, medical foods in Europe operate under a fragmented and ambiguous regulatory framework that hinders innovation and cross border commercialization. Unlike pharmaceuticals, medical foods are regulated under general food law (Regulation EC No 609 2013 on Foods for Specific Groups), which does not provide a clear legal definition for “medical food” as understood in the United States. According to the European Commission’s Food Law Compliance Unit, only infant formula, gluten free foods, and foods for metabolic disorders have harmonized EU rules, while other medical foods fall under national interpretations of “foods for particular nutritional uses.” This patchwork creates uncertainty. In Germany, high protein supplements for sarcopenia may be marketed as medical foods, whereas in Italy they are classified as general foods unless linked to a specific disease. Consequently, companies face redundant testing, labeling revisions, and delayed market access. As per a review by FoodDrinkEurope, compliance costs for multi country launches are high due to divergent national requirements. Without a unified EU category with defined compositional and labeling standards, manufacturers struggle to scale innovations, and clinicians remain hesitant to prescribe products lacking clear regulatory legitimacy.

Limited Reimbursement and Out of Pocket Cost Burden

The absence of consistent public reimbursement for medical foods across most EU member states restricts patient access and dampens prescriber enthusiasm, particularly for chronic outpatient use, which is further impeding the growth of the European medical foods market. According to the European Health Management Association, only a few countries offer partial or full reimbursement for select medical foods, and even then, coverage is often limited to inpatient settings or rare diseases. In the UK, National Health Service formularies rarely include oral nutritional supplements outside hospital walls, forcing patients to pay out of pocket for products that can be costly. As per the data from the European Federation of Crohn’s and Ulcerative Colitis Associations, many patients with inflammatory bowel disease discontinue prescribed medical foods within months due to cost, which is undermining therapeutic efficacy. Even in reimbursing countries, bureaucratic hurdles persist as in France, physicians must submit prior authorization for enteral formulas, which is delaying initiation. According to the European Court of Auditors, fragmented reimbursement policies result in lower utilization of medical nutrition in Southern and Eastern Europe compared to the North. Until medical foods are recognized as cost saving interventions worthy of systematic funding, which is their potential to reduce hospitalizations and improve quality of life will remain unrealized for millions of Europeans.

MARKET OPPORTUNITIES

Expansion into Precision Nutrition for Rare Metabolic Disorders

Europe presents a high value opportunity in the development and delivery of medical foods tailored to inborn errors of metabolism. Conditions such as phenylketonuria, maple syrup urine disease, and urea cycle disorders affect newborns across the EU, all of whom require lifelong amino acid modified formulas unavailable through normal diet. According to the European Society for Phenylketonuria and Allied Disorders Treated as Phenylketonuria, newborn screening programs now cover most EU births, enabling early diagnosis and immediate nutritional intervention. This creates a stable patient base for specialized medical foods that command premium pricing and benefit from orphan product incentives. Companies such as Nutricia and Vitaflo have developed condition specific formulas with improved palatability and micronutrient profiles, supported by real world evidence registries mandated under EU rare disease strategies. The European Medicines Agency collaborates with food safety authorities to streamline dossiers for these products, recognizing their therapeutic necessity. Moreover, the EU’s Horizon Europe program funds projects like “MetabERN” to harmonize care pathways across multiple countries, facilitating pan European distribution. As gene therapies emerge, medical foods will remain essential for managing residual metabolic imbalances, ensuring sustained demand in this scientifically rigorous and ethically compelling niche.

Growth of Home-Based Enteral Nutrition and Digital Health Integration

The shift from institutional to home based care is creating demand for user friendly enteral nutrition systems that integrate with digital health platforms to support remote patient monitoring, which is another prominent opportunity in the European medical foods market. According to the European Wound Management Association, a majority of long-term enteral feeding in Germany and the Netherlands now occurs at home, driven by cost pressures and patient preference. This trend necessitates easy to use pumps, pre filled sterile bags, and modular formulas that caregivers can manage without clinical training. Companies are responding with smart feeding systems that sync with mobile apps to track intake, log symptoms, and alert clinicians to deviations. Fresenius Kabi’s “Infusia Connect” platform, piloted in Swedish home care networks, reduced nursing visits while improving adherence. The European Commission’s Digital Transformation of Health and Care initiative supports such innovations through funding and interoperability standards. Furthermore, telehealth consultations now routinely include nutritional assessments, enabling timely adjustments to medical food prescriptions. According to the data from the Organisation for Economic Cooperation and Development, home enteral nutrition reduces annual per patient costs compared to hospital stays. As Europe’s healthcare systems prioritize deinstitutionalization and preventive care, medical foods will evolve from passive products to active components of connected and patient centred care ecosystems.

MARKET CHALLENGES

Clinical Evidence Gaps and Physician Awareness Deficits

Despite growing usage, inconsistent clinical evidence and limited physician education impede broader adoption of medical foods across non specialist settings, which is a notable challenge to the growth of the European medical foods market. According to a survey by the European Society for Clinical Nutrition and Metabolism, many general practitioners in Southern and Eastern Europe feel uncertain about prescribing medical foods, citing insufficient training and unclear guidelines. While robust data exists for conditions such as cancer cachexia and pressure ulcer healing, evidence for emerging applications is still evolving, which is leading to skepticism among prescribers. Systematic reviews published in Clinical Nutrition note that only a minority of randomized controlled trials on oral nutritional supplements meet high methodological standards, weakening meta-analyses and guideline recommendations. Moreover, medical curricula across Europe dedicate minimal time to clinical nutrition; a study by the University of Copenhagen found that medical students receive limited hours of nutrition education over six years, far below World Health Organization recommendations. Without stronger evidence generation and integration of medical nutrition into professional training, these products risk remaining confined to dietitians and specialists rather than becoming mainstream therapeutic options in primary care.

Supply Chain Vulnerability for Specialized Ingredients

The production of medical foods relies on highly specialized ingredients that are sourced from a limited number of global suppliers, which is creating acute supply chain fragility and further challenging the expansion of the European medical foods market. According to the European Association of Specialty Food Ingredients, most medical grade L amino acids used in Europe are imported from outside the region, with few alternative sources due to stringent purity and certification requirements. Geopolitical tensions, export restrictions, or logistical disruptions can trigger shortages. In recent years, supply chain incidents have caused delays in formula deliveries across several EU countries, which is forcing clinicians to ration supplies. Additionally, the EU’s REACH regulation imposes complex registration obligations on novel food ingredients, deterring new entrants from developing alternatives. The European Commission’s Critical Raw Materials Act does not yet classify medical food ingredients as strategic, which is leaving the sector exposed. Unlike pharmaceuticals, medical foods lack mandatory stockpiling requirements, increasing patient risk during disruptions. Until Europe diversifies sourcing, builds regional synthesis capacity, or establishes emergency reserves for critical components, the continuity of life sustaining medical nutrition will remain vulnerable to external shocks.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2034 |

|

CAGR |

5.31% |

|

Segments Covered |

By Product, Application, Patient Group, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

Danone, Nestlé, Abbott, Fresenius Kabi AG, Targeted Medical Pharma, Inc., and Mead Johnson & Company, LLC |

SEGMENTAL ANALYSIS

By Product Insights

The powder segment accounted for 63.6% of the European medical foods market share in 2025. The dominance of powder segment in the European market is driven by its versatility, high nutrient density, and suitability for both oral and enteral administration across diverse clinical conditions including malnutrition, cancer cachexia, and metabolic disorders. One key driver is its adaptability in clinical and home care settings. Powdered medical foods can be reconstituted into liquids tailored to patient tolerance, which is critical for individuals with dysphagia or gastrointestinal sensitivities. According to the European Society for Clinical Nutrition and Metabolism, a majority of hospital based oral nutritional supplements in Germany, France, and the Netherlands are delivered in powder form due to cost efficiency, storage convenience, and dosing flexibility. Moreover, powders allow precise macronutrient modulation. For instance, renal formulas can be adjusted for potassium and phosphorus content based on lab results, which is a necessity in chronic kidney disease management. The European Food Safety Authority recognizes that powdered formats maintain stability of heat sensitive vitamins like B12 and folate better than ready to drink alternatives when stored properly. Additionally, home caregivers favor powders for their extended shelf life and reduced transport weight. As per the data from the Organisation for Economic Cooperation and Development, home enteral feeding patients using powdered formulas report lower logistics burden compared to liquid counterparts. This functional superiority ensures powders remain the backbone of therapeutic nutrition across institutional and outpatient contexts.

The ready to drink liquid segment is the fastest growing and is estimated to witness a CAGR of 10.4% over the forecast period owing to the rising demand for convenience, adherence support, and improved palatability, particularly among geriatric and pediatric populations. A major factor is the shift toward outpatient and home-based care where ease of use directly impacts treatment compliance. According to the European Commission’s State of Health in the EU report, a large share of long-term nutritional therapy in Sweden and the Netherlands now occurs outside hospitals, necessitating products that require no preparation. Ready to drink formats eliminate mixing errors and ensure consistent nutrient delivery, which is critical for vulnerable groups like elderly patients with cognitive decline. Companies have invested heavily in sensory optimization; Nutricia’s Fortimel Compact Protein range uses advanced formulation technology to mask bitter notes from high protein content, which is achieving high acceptance in clinical trials. Furthermore, these products align with hospital discharge protocols that prioritize simplicity. According to the data from Germany’s Federal Joint Committee, patients prescribed ready to drink supplements had higher adherence rates at 30 day follow up compared to powders. With urbanization limiting caregiver time and retail pharmacies expanding medical food aisles, ready to drink formats bridge clinical efficacy with consumer expectations for immediacy and taste.

By Application Insights

The inborn errors of metabolism segment held 36.3% of the regional market share in 2025. The dominating position of the segment in the European market is driven by the absolute dietary dependency of affected patients who require lifelong amino acid modified formulas to prevent irreversible neurological damage or death. A primary driver is universal newborn screening and early intervention mandates. According to the European Society for Phenylketonuria and Allied Disorders, most EU births are now screened for metabolic conditions within 72 hours, which is enabling immediate prescription of condition specific medical foods. For phenylketonuria alone, patients must consume phenylalanine free formulas from diagnosis through adulthood. National health systems recognize this as non-negotiable care as France’s National Health Insurance fully reimburses metabolic formulas, while Germany includes them in its orphan disease support framework. The European Medicines Agency collaborates with food safety authorities to fast-track dossiers for these products, acknowledging their life sustaining role. According to the data from the European Reference Network for Rare Diseases, early and consistent use of medical foods reduces intellectual disability incidence in treated cohorts. With hundreds of recognized inborn errors requiring specialized nutrition and strong advocacy from patient organizations, this segment benefits from stable demand, regulatory clarity, and ethical urgency unmatched in other therapeutic areas.

The cancer cachexia segment is the fastest growing and is predicted to expand at a CAGR of 12.2% over the forecast period in the European medical foods market. The rising cancer incidence, integrated oncology nutrition protocols, and robust clinical evidence linking nutritional support to treatment tolerance and survival are propelling the growth of the cancer cachexia segment in the European market. According to the International Agency for Research on Cancer, millions of new cancer cases were diagnosed in Europe in 2023, with many advanced patients developing cachexia, which is a wasting syndrome characterized by muscle loss and metabolic dysfunction. The European Society for Medical Oncology now mandates nutritional screening at every oncology visit and recommends high protein, omega 3 enriched medical foods to counteract inflammation and preserve lean body mass. Clinical trials published in The Lancet Oncology demonstrate that patients receiving EPA enriched oral supplements maintained more muscle mass compared to controls, significantly improving chemotherapy completion rates. Hospitals across the UK and Italy have embedded dietitians in tumor boards ensuring timely prescription. Moreover, reimbursement pathways are expanding. In the Netherlands, cachexia specific formulas were added to its basic insurance package. As immunotherapy and targeted therapies extend survival duration, nutritional support becomes a longitudinal pillar of care, which is transforming medical foods from palliative aids to integral components of precision oncology.

By Patient Group Insights

The geriatric segment commanded for the leading share of 46.4% of the regional market in 2025 due to the Europe’s aging demographic structure and the high prevalence of age-related conditions such as sarcopenia, malnutrition, and chronic disease that necessitate therapeutic nutrition. A key driver is the clinical recognition of malnutrition as a modifiable risk factor in elderly care. According to Eurostat, a significant proportion of the EU population was aged 65 or older in 2023, and this cohort accounts for a large share of hospital admissions. As per the European Society for Clinical Nutrition and Metabolism, many communities dwelling seniors exhibit protein energy malnutrition, often exacerbated by dental issues, reduced appetite, and polypharmacy. National guidelines increasingly mandate screening. Germany’s Geriatric Guidelines require Mini Nutritional Assessment at every primary care visit for patients over 70. Medical foods are prescribed to prevent falls, fractures, and hospital readmissions. According to the data from the Swedish National Board of Health, geriatric patients receiving oral nutritional supplements during hospital discharge had fewer readmissions within 90 days. Furthermore, long term care facilities in France and the Netherlands integrate medical foods into daily meal plans as standard practice under national quality frameworks. This systemic embedding ensures consistent high-volume demand driven by both clinical necessity and policy enforcement.

The pediatric segment is the fastest growing and is predicted to record a CAGR of 11.4% over the forecast period in this regional market owing to the advances in neonatal care, expanding indications for medical foods, and strong reimbursement support for rare diseases. Premature birth rates remain stable across Europe, but survival rates have improved due to advanced NICU protocols that include early enteral feeding with specialized preterm formulas. These products provide tailored levels of DHA, ARA, and nucleotides critical for neurodevelopment. Beyond prematurity, the diagnosis of inborn errors of metabolism creates lifelong dependency on medical foods from infancy. The European Union’s Cross Border Healthcare Directive facilitates access to specialized formulas across member states, ensuring continuity of care. Reimbursement is robust as in Italy, the National Health Service covers metabolic formulas for children with no age cap. Moreover, parental advocacy groups exert strong influence; the European Federation of PKU Associations successfully lobbied for inclusion of glycomacropeptide based formulas in national formularies. With rising awareness of early nutrition’s impact on lifelong health and increasing survival of complex pediatric cases, demand for age specific medical foods will continue to outpace other segments.

REGIONAL ANALYSIS

Germany Medical Foods Market Analysis

Germany led the medical foods market in Europe in 2025 by holding 24.4% of the regional market share in 2025. The dominance of Germany in the European market is driven by its comprehensive healthcare infrastructure, aging population, and strong regulatory support for therapeutic nutrition. Malnutrition screening is mandated in hospitals under German Medical Association guidelines, and oral nutritional supplements are included in Disease Management Programs for diabetes and heart failure. According to the Federal Statistical Office, a significant share of Germans are aged 65 or older, creating sustained demand for geriatric formulations. Reimbursement is well established, with the Federal Joint Committee approving medical foods for inpatient and select outpatient use. Germany also hosts leading manufacturers such as Fresenius Kabi and Nestlé Health Science, whose R&D centers focus on condition specific formulations validated through real world evidence registries. The presence of specialized clinics for metabolic disorders and oncology further embeds medical foods into standard care pathways. This ecosystem of policy, clinical integration, and industrial capacity solidifies Germany’s position as Europe’s most mature and scientifically rigorous market.

France Medical Foods Market Analysis

France occupied 19.1% of the European market share in 2025. The growth of France in the European medical foods market is attributed to the universal healthcare coverage, strong pediatric metabolic programs, and centralized reimbursement mechanisms. The French National Authority for Health recommends medical foods for numerous rare diseases including phenylketonuria, with full coverage under the national health insurance scheme. According to the French Ministry of Health, newborn screening for metabolic conditions has been mandatory since 2022, ensuring early diagnosis and immediate nutritional intervention. Hospitals operate under strict nutritional care standards, requiring certified dietitians to prescribe medical foods as part of multidisciplinary teams. Data from the National Health Insurance Fund shows that reimbursement claims for medical foods grew in 2023, reflecting expanded indications in oncology and geriatrics. France’s “Ma Santé 2022” strategy prioritizes preventive nutrition, reducing long term complications. With high public trust in state mediated healthcare and robust scientific oversight, France maintains consistent demand across both rare disease and chronic care applications.

United Kingdom Medical Foods Market Analysis

The United Kingdom is estimated to showcase a promising CAGR in the European medical foods market during the forecast period. The National Health Service protocols, academic medical centers, and post Brexit regulatory autonomy are driving the UK market growth. NHS England restricts outpatient reimbursement for general malnutrition but funds medical foods for inborn errors of metabolism and cystic fibrosis through specialized commissioning groups. According to the UK National Screening Committee, all newborns are screened for metabolic conditions, creating a stable pediatric patient base. Leading hospitals such as Great Ormond Street and Royal Marsden integrate medical nutrition into tumor boards and metabolic clinics, ensuring evidence-based prescribing. The National Institute for Health and Care Excellence includes oral nutritional supplements in guidelines for hip fracture recovery and cancer cachexia, driving institutional adoption. According to the data from NHS Digital, hospital procurement of medical foods increased in 2023 due to rising geriatric admissions. The UK’s Medicines and Healthcare products Regulatory Agency maintains clear guidance distinguishing medical foods from supplements, enhancing regulatory predictability. This blend of clinical excellence, targeted funding, and scientific clarity sustains the UK as a high value market despite reimbursement limitations.

Italy Medical Foods Market Analysis

Italy is predicted to account for a notable share of the European medical foods market during the forecast period owing to its universal coverage for pediatric metabolic disorders and strong family centred care culture. The Italian National Health Service provides full reimbursement for medical foods for all inborn errors of metabolism, reinforced by rare disease legislation. According to the Italian Ministry of Health, specialized metabolic centers operate nationwide, ensuring coordinated care from diagnosis through adulthood. As per the from the Italian Medicines Agency, prescriptions for amino acid modified formulas grew in 2023, driven by expanded newborn screening. Geriatric demand is also rising; with a large share of Italians aged 65 or older as per ISTAT, hospitals increasingly use high protein supplements to manage sarcopenia and pressure ulcers. Family caregivers play a central role in administration, fostering adherence and long-term use. Italian clinicians favor palatable formulations, leading local distributors to partner with global brands on flavor innovation. This combination of policy, compassion, and clinical engagement creates a resilient market anchored in both rare disease and aging care.

Netherlands Medical Foods Market Analysis

The Netherlands is projected to showcase a prominent CAGR in the European medical foods market over the forecast period owing to the integrated care models, data driven reimbursement, and leadership in home based enteral nutrition. The Dutch Healthcare Institute includes medical foods in its Diagnosis Treatment Combination system, which is allowing hospitals to bill for nutritional therapy as part of bundled care packages. According to the Central Bureau of Statistics, a significant proportion of the population is aged 65 or older, and most long-term enteral feeding occurs at home due to the district nurses and digital monitoring platforms. The Netherlands is also a hub for clinical research as the University Medical Center Utrecht runs Europe’s largest cachexia registry informing product development and guideline updates. Reimbursement is pragmatic, requiring products to demonstrate cost effectiveness through reduced hospital stays or complication rates. According to the data from Zorginstituut Nederland, introduction of omega-3 enriched formulas for cancer patients lowered average treatment costs per patient in 2023. Moreover, the country’s dense network of dietitians ensures early identification and management of malnutrition across primary and secondary care. This evidence based, efficient, and patient centered approach positions the Netherlands as a benchmark for sustainable medical nutrition integration.

COMPETITIVE LANDSCAPE

Competition in the Europe medical foods market is defined by scientific rigor regulatory sophistication and deep integration into healthcare systems rather than price alone. Incumbent leaders leverage decades of clinical research robust manufacturing compliance and established relationships with hospitals dietitians and reimbursement authorities to maintain dominance. New entrants face high barriers including the need for disease specific evidence complex regulatory classification under EU food law and limited reimbursement pathways outside select indications. The market is bifurcated between rare disease segments and broader areas like geriatric malnutrition where out of pocket costs constrain access. Competition extends into service innovation with companies offering digital tools training and home delivery to improve adherence. While private label offerings exist, they remain marginal due to trust requirements in therapeutic contexts. Consolidation is ongoing as pharmaceutical and nutrition giants acquire niche players to expand portfolios. Ultimately leadership is determined by the ability to generate credible evidence navigate fragmented reimbursement landscapes and embed products into standardized care protocols across diverse European health systems.

KEY MARKET PLAYERS

Some of the notable key players in the Europe medical foods market are

- Danone

- Nestlé

- Abbott

- Fresenius Kabi AG

- Targeted Medical Pharma, Inc.

- Mead Johnson & Company, LLC

Top Players in the Market

- Nestlé Health Science is a global leader in medical nutrition with a deeply entrenched presence across Europe through brands like Nutricia and Resource. The company offers a comprehensive portfolio spanning oral nutritional supplements enteral formulas and disease specific medical foods for conditions including cancer cachexia Alzheimer’s and inborn errors of metabolism. Nestlé Health Science collaborates closely with European healthcare institutions to embed its products into clinical pathways and national guidelines. Recently the company expanded its research partnership with University Hospital Leuven to validate next generation omega 3 enriched formulas for oncology patients. It also launched a digital adherence platform in Germany and France that syncs with electronic health records to track patient intake and support remote dietitian consultations reinforcing its shift from product supplier to integrated care partner.

- Fresenius Kabi is a German multinational specializing in infusion therapy and clinical nutrition with a strong foothold in hospital and home-based enteral feeding across Europe. The company provides sterile ready to use enteral formulas tailored for critical care renal disease and metabolic disorders meeting stringent EU pharmacopeia standards. Fresenius Kabi leverages its hospital distribution network to ensure seamless integration into institutional protocols particularly in intensive care and geriatric units. In recent years the company enhanced its smart feeding systems by integrating IoT enabled pumps with cloud-based monitoring for home care patients in Sweden and the Netherlands. It also invested in a new production line in Bad Homburg dedicated to amino acid modified formulas for rare diseases aligning with EU orphan nutrition policies and strengthening its position in high compliance therapeutic segments.

- Danone Nutricia is a Netherlands based pioneer in medical nutrition renowned for its science driven approach and leadership in pediatric and neurological medical foods. The company developed some of the first evidence-based formulas for phenylketonuria Alzheimer’s and dysphagia now used in over 100 countries. In Europe Nutricia works directly with national screening programs and metabolic centers to ensure early access to specialized products. Recently the company introduced a new line of high protein oral supplements with improved palatability for elderly patients using micro emulsion technology validated in multicenter trials across Italy and Spain. It also partnered with the European Federation of PKU Associations to launch educational resources for caregivers enhancing real world adherence. Through continuous clinical investment and patient centric innovation Nutricia maintains its reputation as a trusted partner in both rare disease and aging nutrition.

Top Strategies Used by the Key Market Participants

Key players in the Europe medical foods market pursue strategies centred on clinical validation regulatory engagement and care integration. Companies invest heavily in randomized controlled trials and real-world evidence to substantiate health claims and influence national guidelines. Strategic partnerships with hospitals universities and patient organizations enhance credibility and accelerate adoption. Product innovation focuses on palatability texture modification and condition specific formulations to address unmet clinical needs. Digital health integration through adherence apps and remote monitoring platforms extends value beyond the product into service ecosystems. Reimbursement advocacy remains critical with firms actively engaging health technology assessment bodies to demonstrate cost effectiveness. Geographic localization includes adapting flavors packaging and dosing to regional dietary habits and care models. These approaches collectively position medical foods not as commodities but as essential components of precision nutrition within Europe’s evolving value-based healthcare landscape.

MARKET SEGMENTATION

This research report on the European medical foods market has been segmented and sub-segmented based on categories.

By Product

- Powder

- Pills or Tablets

- Liquid

- Soft gel Capsules

- Other Formats

By Application

- Diabetic Neuropathy

- Cancer related Cachexia

- ADHD

- Alzheimer’s Disease

- Metabolic Disorders

- Gastro intestinal Disorders

- Chronic Kidney Disease

- Other Applications

By Route of Administration

By Patient Group

- Pediatric

- Adult

- Geriatric

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

link